I recently saw a video on YouTube with advice from Mark Cuban on how to get rich. I found one piece of advice particularly interesting: that buying non-perishable consumable goods in bulk or on sale is going to give you a better return on investment than any traditional investment opportunities (stocks, real estate, etc.). Return on investment (ROI) is a financial concept – it’s a measure of how beneficial it is to tie up money in a particular investment. I was curious to calculate the ROI from buying goods in bulk, and the only example I found online of someone attempting the same calculation used a bizarre and almost certainly incorrect method.

First, we can define ROI for traditional investments. ROI is typically given in percent per year: if a certain stock has an ROI of 10%, that means that if you buy $100 of that stock, you could sell it one year later for $110. The simplest ROI calculation can be made as follows:

![]()

Note: technically the term for this financial concept is Compound Annual Growth Rate (CAGR). I will use “ROI” throughout this post since it’s an acronym that gets used much more often than CAGR – even though CAGR is the better measure and they’re fundamentally trying to measure the same thing: investment performance. Also, I assume Mark Cuban meant CAGR even though he said ROI.

We can see that plugging in the numbers from the stock example above (an amount paid of $100, a final value of $110, and being invested for 1 year) indeed gives an ROI of 0.1, or 10%. A slightly more complicated example might be that you buy a rental property for $200,000, the property has a net income of $1,500/month, and after 8 years you sell the property for $300,000. Plugging in these numbers (final value = 300,000 + 1,500*12*8, amount paid = 200,000, and years invested = 8) gives an ROI of about 10.5%. This would indicate that the rental property was only a slightly better investment than the stock. Most traditional investments that don’t require a large amount of capital will have ROIs from 5 – 15%, so that’s the target that buying in bulk should beat if Mark Cuban’s advice is sound.

It should be noted that this ROI calculation assumes you pay the total cost up front and collect the total value at the end of the investment. In reality, the rental property is more valuable than we’re calculating with this simple formula, since you collect rent over the course of owning the property, not in a lump sum at the end. This means you could be reinvesting that rental income as you receive it, and you could be earning additional returns in the meantime that we’re not accounting for. Even so, this ROI calculation is still useful for comparing different investments, and we’ll ignore this timing shortcoming for now.

ROI of buying in bulk

Buying in bulk isn’t exactly an investment, but it follows the same principle since we’re tying up our money in something (in this case, non-perishable consumables rather than stocks or real estate) because we think we’ll end up with more money in the long run. As an example, suppose that I typically buy a $10 package of toilet paper which lasts me one month. In a year, I’ll go through 12 of these packs, spending $120 on toilet paper. At a bulk supply store, I might have the opportunity to buy a year’s worth of toilet paper for $100, a 17% savings. What would the equivalent ROI be? Here the amount paid is clearly $100. For the simple ROI calculation, we can say that the final value is $120, since I’m getting $120 worth of toilet paper compared to my usual shopping habits, and we can say that I’m invested for 1 year, since I have to pay for the toilet paper 1 year ahead of when I’ll finish using it. In this case, the ROI would be:

![]()

The equivalent of a 20% return, much better than most traditional investments!

ROI of buying on sale

We can also use the same formula to calculate ROI for situations when a product is on sale. Suppose I go to the store one day and the toilet paper I usually buy is $7 a pack (30% off). What’s the ROI, and how much should I buy? In this case, the ROI of a particular pack of toilet paper depends on how far in the future I’ll end up using it. Each pack costs $7 and gives me $10 of value, but the number of years invested depends on how many packs I’m buying. For example, for my sixth pack it will take half a year before I use it, which yields:

![]()

That sixth pack has an ROI of 104%, an awesome investment! Suppose I really go to town and buy 5 years worth of toilet paper. That means for the last pack, I’ve invested that $7 for 5 years, and the ROI is given by:

![]()

While still a reasonable return, a 30% discounted pack of toilet paper that I don’t use until 5 years later isn’t necessarily beating traditional investments.

Carrying costs and increased consumption

The calculations above neglect some costs which could potentially reduce the ROI on buying in bulk/on sale. The first is carrying cost, which refers to the cost of storing a bunch of stuff that you aren’t using yet. For some goods (like toothpaste) this probably isn’t a big deal, but for the toilet paper example, it likely would be. Suppose I bought 2 years worth of discounted toilet paper, as in that case the last pack would still have an ROI of almost 20%, which is a very solid return, but I only have enough room in my apartment to store 1 year worth of toilet paper. My building rents storage bins for $60/year which would be sufficient to store all the extra toilet paper, so for the first year I have to spend an extra $60 to hold all the toilet paper. In this case, the overall ROI would be given by:

![]()

Since I have to pay extra money to be able to store the toilet paper, it completely kills the savings, and I’m left with a meager 2.6% ROI. Usually carrying cost is more difficult to factor into the calculation than this, but it’s worth keeping in mind that if a large portion of your house is being used for storage, buying in bulk probably isn’t doing you that much good, and you could lower expenses overall by living somewhere smaller without the bulk buying.

Another trap you should be careful of is increased consumption of the good you bought in bulk. In the bulk toilet paper example (12 packs for $100), the value I’m getting is $10/month, since that’s how much I usually spend on toilet paper. If I start using toilet paper to clean up spills in the kitchen since I have so much TP lying around (whereas I used to use reusable sponges), and this causes me to go through 12 packs of toilet paper in 11 months, then my ROI would be:

![]()

By increasing my consumption by ~9%, the original ROI of 20% is cut almost in half. So while buying in bulk/on sale can provide good ROI, you should be careful about carrying costs and increased consumption, which can negate or even reverse the return.

It’s also worth noting that if you buy something on sale which you normally wouldn’t buy at all, it can’t be treated as having an ROI in the sense we’re looking at here. While you can still get value from it, you’re not saving money since in the absence of the sale you wouldn’t have bought the item, and therefore wouldn’t have spent any money at all.

Some interesting math

There is some interesting math to explore following this treatment of buying in bulk/on sale as an investment. We can rearrange the ROI equation to find how much of a good we should buy when it goes on sale based on the ROI we want to achieve:

![]()

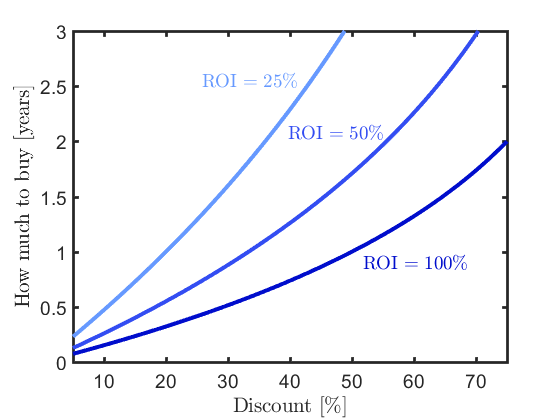

where t is how much of the thing we should buy in years (for example, if the calculation yields t = 2, you should buy enough of the item on sale to last you 2 years). This is plotted for a few target ROI values below:

As an example, if you’re targeting an ROI of 50%, and the laundry detergent you usually get is 40% off, our ROI calculations say you should buy ~1.3 years worth of detergent. If you want an ROI of 100%, you should only buy 9 months worth of detergent, whereas if you are happy with an ROI of 25%, you can buy ~2.3 years worth of detergent. This chart can also be used to decide whether buying in bulk is worth it. In this case, if the bulk point is up and to the left of your target ROI curve, you shouldn’t buy, but if it’s down and to the right, you should. For example, if we can get a 17% discount by buying 1 year worth of toilet paper, that point is located up and to the left of all three of these ROI curves, indicating that it’s a worse ROI than any of those values (we know it’s 20% from calculating it before).

In general is seems like the ROI on buying in bulk/on sale is very good, so why don’t we “invest” more of our money this way? The funny thing about this “investment” is that the better the ROI, the less money we’re able to invest. Looking back at the toilet paper example, for something that has a bulk discount of 17%, the most I’d be able to “invest” for one year is 83% of my typical annual spending. If the bulk discount was instead 33%, corresponding to an ROI of 50%, I’d only be able to “invest” 67% of my typical annual spending. Larger discounts lead to higher ROI, but they also lead to lower investment potential:

![]()

Typically when you find a good investment opportunity, you want to put as much of your money in it as possible. However with buying in bulk, your investment potential is inherently limited by your normal spending, and is lower the better the discount.